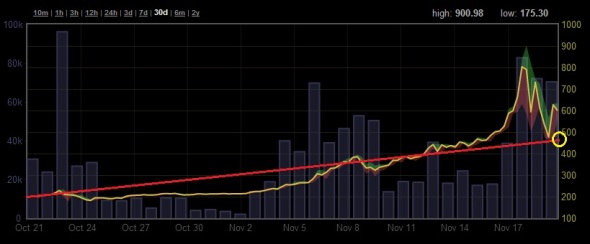

BitCoin Update – 11/20/2013

Posted: 11/20/2013 Filed under: BitCoin, Economy | Tags: bitcoin, bitcoin news, btc, BTC China, mt gox, november 2013 bitcoin Leave a commentIt’s been several months since I last posted anything about BitCoins but let’s be honest, they didn’t give me much reason to write anything. That is, until October rolled around and the new normal quickly went from a tepid range of $70-$120 per bitcoin (BTC) to a staggering $500-$800 range just over the last 7 days. How? Why??? The New Yorker wrote a good piece about it lately identifying the main culprit for the spike to be the newly minted monster exchange called BTC China which has overtaken the undisputed giant Mt. Gox in a short period of time. Piled on top of this is our own US Congress dictating that they are mulling over the use of BitCoins as a legal form of currency (as it isn’t already) and expand it’s use throughout the USA. In either case, the sudden spike is very hard for many to digest but like any rapidly rising commodity/currency, there is always room for an equally rapid fall. Be cautious buying at these prices. Check out my charts below:

Based on this chart, I would stay far away from buying BitCoins regardless of my intent of what I will do with it, chaos abounds.

This is a 30-day chart, notice the trendline would have only pegged each BTC at roughly over $450, this is where I think it should be even factoring in the sudden spike in demand from China after weeding out global speculation.

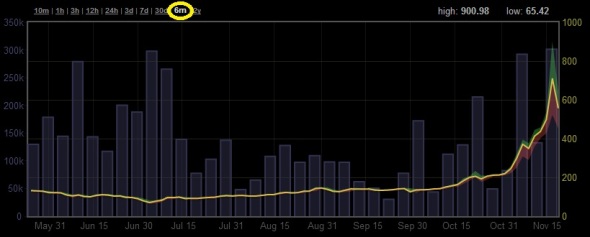

Now here is insanity. This chart is only using a 6 month time horizon but it already looks eerily similar to that of a penny stock that just got pumped up by a massive spam email campaign. This is the scariest chart to me telling me to stay out of this if you are a new bitcoin buyer. If you held on during the boring era, congrats! Sell on the hype and wait. Until next time.

4 Life Lessons Learned from Playing Poker Tournaments

Posted: 08/23/2013 Filed under: Consumerism, Entertainment, Life, Poker | Tags: don schlitz, life lessons, not gambling, poker, poker life, poker tournaments, the gambler, zynga poker Leave a commentI’ve been killing time lately playing Zynga’s Poker app on my iPhone when it struck me to write this profound post. First off, I am in the camp that poker is not gambling. This was coincidentally a ruling from a Federal judge just last year overturning the conviction of a poker room operator in Staten Island, NY (link at the bottom of post). Having engaged in several forms of gambling over the years out of sheer curiosity and exhilaration, I discovered to have the most control over the game of poker, Texas Hold ’em to be exact.

I don’t consider myself a good player by any means, but I have made it to final tables in a few casino tournaments to experience first hand what all the fuss is about. After usually 5+ hours of grueling mental battles with a carousel of 8 other strangers at your table at a time, there is an incredibly euphoric feeling when you make it to the final table. The guarantee that no matter how you do at this point, you will be compensated for your time and mental anguish, how much you are compensated will depend on fending off the other equally hungry sharks sitting around you. However, the point of my post is not to revel in the feeling of winning a tournament, rather how it has eerie parallels to success in life.

Humility– Among the many virtues learned from playing Hold ’em, high on that list is to remain humble. The moment you get a big head and start playing less cautiously and constantly bluff your opponents out of their money; you eventually get called out and lose. Sometimes quite significantly.

Risk-Taking– Getting to the final table does not happen by playing it safe for 5-10 straight hours. You will end up just losing as the blinds get higher and higher. Waiting for the perfect hand is not a winning strategy in poker, nor is it in real life. If you want to get to the final table, you must take calculated risks along the way. Luck plays the same role in real life as it does in poker; you never know when it will strike.

Greed– The most obvious lesson learned from playing poker. Not as much as a factor when you are playing in a tournament because you have already committed a fixed amount of money to buy into the tournament. However, if you are allowed to re-buy into the tournament, the element of greed can rear its ugly head telling you that this time will be different. Who knows, it might be, but when do you stop buying in and realizing you are just throwing good money after bad?

Patience– Almost contradicting risk-taking, you still have to be patient to succeed in poker. If your intent is to play every hand dealt with hopes that you will out bluff your opponents and just get lucky on some hands, you will just set yourself up for disappointment and en early exit from a tournament. Most of the pros still bluff with playable cards in the hole (cards in their hands) so when someone does call them, they will still have a fighting chance to win the hand. I don’t have to tell you that patience has its virtues in real life as well.

There you have it.

You have to really respect Don Schlitz for writing The Gambler back in 1978 (made famous by Kenny Rogers’ vocals of course), he must played his fair share of cards.

Link: http://reason.com/blog/2012/08/22/federal-judges-says-poker-is-not-gamblin

Last Call for Cheap Mortgage Rates? – June 25, 2013

Posted: 06/25/2013 Filed under: Consumerism, Economy | Tags: bernanke, Case-Schiller, fomc meeting, housing inflation, mortgage, mortgage rates, Quantitative Easing, rising rates Leave a commentFor some reason, if you are home owner and had not taken advantage of the record low rates during the last 18 months, your window of procrastination may be closing, very quickly. According to the Primary Mortgage Market survey conducted weekly by Freddie Mac, the June 20, 2013 reading for a 30-year Fixed Rate Mortgage (FRM) averaged 3.93% with 0.8 points (meaning you pay 0.80% of the loan amount to get that interest rate).

No big deal, we are only marginally off the record lows of 3.31% set around November 2012. Except, notice that the reading was taken only one day after our Chief Economist Ben Bernanke also provided us with his periodic riddles on the outlook of our economy, known to most as the FOMC meeting. Not even a week later, most major banks are reporting 30-year FRM rates as high as 4.625%, a nearly 0.70% increase in mortgage rates.

To put things in better perspective, a $300,000 mortgage last week would have cost you approximately $1,420/month versus $1,542/month today, a difference of $122/month for the next 30 years just by waiting a week to have locked in your mortgage rate. For people with tighter constraints on their maximum monthly payments, their purchasing power just reduced by about $22,000.

This extreme volatility reared its ugly head only because Mr. Bernanke strongly hinted that at our current pace of economic improvement, the Fed will stop their monthly $85 billion Quantitative Easing plan. If you take the training wheels off a bike as the child is just getting the hang of riding, the child will inevitable fall of that bike a few times. This spike in rates is our first fall off the bike; I expect more falls to follow.

The silver lining here is that even at 4.625%, interest rates are still very low relative to renting a home right now. According to a Bloomberg report, rates would have to reach over 10% to make renting a better option than owning a home.

BitCoin Update: June 14, 2013 – How to tell when hype is over?

Posted: 06/14/2013 Filed under: BitCoin, Economy, Technology | Tags: bitcoin, bitcoin chart, bitcoin price, bitcoins, btc, btcusd, coindesk, prism Leave a commentSorry for the long break in BitCoin related posts, my other day job got in the way, hate when that happens!

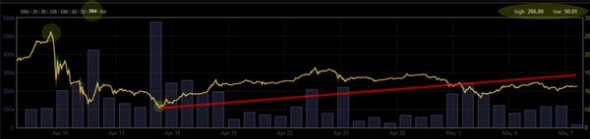

Over the last few months I have been passively tracking the price of bitcoins relative to the US Dollar (since I live in the USA, makes sense) and noticed that after the huge explosion of media exposure in late May 2013 through early April 2013 leading to the record high over $240/BTC followed by a plunge (bubble burst as some of you would call it) shortly after into the $50 range; it has become relatively quiet. That’s not my intent for writing this latest post though.

I have attached a very telling 6-month chart below that illustrates how ridiculous the meteoric rise just looks in retrospect and how it is actually settling at a more reasonable exchange rate of nearly $100/BTC while I write this. Personally, I think this can settle a little bit lower into the $80 range (based on my own 60-day EMA), but I will accept $100/BTC as a reasonable rate right now given the global demand for decentralized currency is definitely there and not expected to wane in the near future.

Due to further distrust in our various governments, I was expecting huge inflow into Bitcoin after the whole PRISM scandal was dripped out, but the exact opposite happened. Turns out people freaked out that they were caught doing whatever they were doing and sold off mass quantities of bitcoin. Don’t worry, it’s already starting to recover. Check out this graphics and post from CoinDesk here.

Enjoy the graphic and your weekend.

Commercial Holidays are for Dummies. Don’t be a Dummy!

Posted: 06/06/2013 Filed under: Consumerism, Entertainment, Television, Venting | Tags: christmas, commercial holiday, father's day, holidays, mothers day, pointless holidays, valentine's day Leave a commentI am going out on a crazy crusade (probably by myself) against commercial holidays. What spurred this instant crusade was watching my 5th straight commercial in a 10 minute period about Father’s day cakes, Father’s day shirts, Father’s day cell phone sales, Father’s day car sales… the list went on. You may be asking yourself right now, why the hell are you watching commercials don’t you have a DVR? Yes, I do. But every show I would normally watch is on hiatus for several long and grueling months so now I am forced to watch the mindless drivel that fills the rest of my cable air space (i.e. whatever is on National Geographic channel right now).

Do you know how to tell if a holiday is more commercial than it is sentimental? I do.

I have come to the conclusion that there is a direct relationship between the amount of TV commercials and the level of pointlessness that a certain holiday carries. How often do you ever see a commercial target birthdays? I rarely do. Maybe I have become more cynical in my older age (mid-30s) but I’m really bothered when I hear someone frantically stress over what they are going to buy their secretary for administrative assistants day. AHHH!

Instead of listing every holiday that I never plan to buy a gift for someone, I will just list the days that I will actually buy something: Your Birthday & New Years Day (champagne bottle).

With the exception of religious holidays like Hanukkah and Christmas, other holidays just should be observed, you don’t have to buy jack to show you care. Just observe it, the way it was meant to be. Don’t feel obligated to buy your dad another tie or iPad because 200 commercials tell you it’s the right thing to do.

Ok, rant over. Enjoy your gift cards.

BitCoins Maturing Sooner Than We Thought

Posted: 05/08/2013 Filed under: Economy, Technology | Tags: bitcoin, bitcoins, btc, btc trend, btcusd, bubble, may 2013, mtgox, usd, usdbtc 2 CommentsIt’s hard to believe that only 30 days ago we were in the midst of the first major Bitcoin bubble burst as some critics called it. The US Dollar (USD) to BitCoin (BTC) rate spiked to as high as $260 around April 9th only to plunge to just above $50 in a matter of 24 hours, erasing weeks of gains as well as months and years of confidence in the future of the digital currency. Once the media storm blew over and news of the Boston Marathon bombings rightfully took over the global news outlets, BitCoins became yesterday’s news. The currency needed this media vacation to let the market digest all the publicity it had received and for lack of better words, find itself again.

With the exception of the shut-down of the budding BitCoin trading platform BitFloor, the last 3 weeks have proven to be quite uneventful and I’m fine with that. Backing up for a minute, BitFloor was on track to be my favorite site for the sheer fun of trading BTC/USD pairs at relatively low transaction costs. Unfortunately, for reasons I am still not really certain about, their US banks cut them off and eventually led them to peacefully close down and refund existing accounts to their customers; a very nice gesture to say the least, considering how the entire network is anonymous and could have easily just walked off with everyone’s money.

BitCoin seems to show some maturing much sooner than I or many others probably anticipated simply by how it is acting right now in a period of little economic activity and with a hiatus from the limelight of CNBC and Fox News. Check out my 30 day chart below to see what I mean. Prices seem to be somewhat stabilizing in the range of $150-$90, which is not that volatile considering the previous wild swings we were becoming accustomed to prior to the great ‘burst’. The various BTC trading platforms and overall market does not look like it is losing steam nor are BTC holders losing confidence as the media hyped it would ultimately happen, once again another reason to tune them out and just watch the actual facts unfold. Enjoy the silence while it lasts.

Achilles tendonitis remedy that worked for me

Posted: 04/22/2013 Filed under: Fitness | Tags: achilles, achilles heel, achilles remedy, heel, heel pain, remedy, runners stick, tendonitis, tendonitis remedy Leave a commentFor the last 3 weeks I have been waking up with a pain so sharp in my right ankle area that I have to hobble on one foot for most of the morning. Turns out that pain was caused by my achilles tendon being inflamed. I’m no doctor, but that doesn’t sound like a good thing. I’m guessing it was caused when I decided to run through the woods on rough uneven terrain for a few miles, felt good at the time.

There was plenty of good information that explains how it’s caused here: http://orthopedics.about.com/cs/ankleproblems/a/achilles.htm

I am not an athelete by any means, but when I can’t play the few sports I enjoy playing (volleyball, tennis) then i get irritated and start putting on some pounds as well. I went online to see what the brilliant forums held for me and found this extremely crude device called the Runner’s Stick. It can literally be substituted for a rolling pin you find in the kitchen. In fact, I initially used a rolling pin from the kitchen until I was yelled at for rubbing a rolling pin on my calves; awkward situation really.

Basically, all you do is sit down with both legs out in front of you and use this not-so-fancy roller under the calf muscle that corresponds to you the leg you are having the achilles tendon pain. You roll out the tension in that calf muscle and it miraculously relieves tension from the achilles tendon below in the process. One thing to note: once you find the tender area on your calf muscle, you need to work that area over repeatedly for about 3 minutes with a decent amount of pressure. I won’t lie, it hurts, a lot. But once you’re done you can stand up and the achilles pain is almost non-existent. Enough so that I was able to play 3 hours of tennis the other day. You just have to keep doing it and apply ice when possible to truly rid yourself of the pain.

Here is the stick if you want to check it out:

Link to Runner’s Stick or here

Hope it works. Good luck.

Healthy Spicy Tilapia with Brown Rice

Posted: 04/18/2013 Filed under: Food | Tags: brown rice, cayenne, cooking, flax seed, grapeseed oil, healthy, healthy cooking, olive oil, recipe, tilapia Leave a comment

Pan-fried Tilapia served on brown rice. This is what it should look like when you’re done.

Can something be healthy and fried? Probably not, but this came out really good. I’m on this kick now to eat healthier, well I’m trying at least. Baby steps right? I picked up some brown Basmati rice from Trader Joe’s and had a Tilapia filet from Harris Teeter just lying around in the fridge, so I came up with this tasty concoction. Enjoy.

What you’ll need:

- a Tilapia filet

- 1 tablespoon cayenne pepper powder

- 1 tablespoon smoked paprika (regular paprika will still do)

- 1 tablespoon ground flax seed powder

- salt

- 2 tablespoons grapeseed oil (or olive oil)

- 1 tablespoon onion powder

- 1 clove garlic

- fresh oregano (dried should work too)

- 1 cup brown rice

Before you start the fish, start cooking the brown rice with a teaspoon of olive oil and a few dashes of salt in the water. Oh yea, you should probably have a rice cooker to make this step really easy on you. You will use a ratio of 1 part rice to 2 parts water. You can add a little more water if you like since brown rice takes longer to cook.

Take the Tilapia filet and dredge it in the mixture of cayenne pepper powder, smoked paprika, a dash of salt, flax seed powder and onion powder. You can make this more spicy by adding more cayenne pepper if you like, that’s what I did, I love spicy food. Basically you want to coat both sides of the fish with this mixture and then set it aside.

In a frying pan, heat up the grapeseed oil (or olive oil, whatever) on medium-high heat. Cut the garlic clove in half and drop it into the oil along with fresh oregano leaves (or dried oregano). Let the garlic flavor the oil for a couple minutes. Place the tilapia filet in the frying pan and fry it for about 4-5 minutes on each side or until it’s nice brown and crispy. When done, lay it out on a paper towel to absorb excess grease. Place the tilapia over the cooked rice and enjoy.

If you can’t find flax seed powder, you can just take flax seeds and ground them in a mortar & pestle. I just pick up a bag from Wegman’s nearby. I think Trader Joe’s or Whole Foods carries it as well.

Gold vs. Bitcoin: Seven Days of Corrections

Posted: 04/17/2013 Filed under: Economy, Investing, Technology | Tags: bitcoin, bitcoins, btc, bubble, correction, cypress, draghi, gold, usdbtc 1 CommentWhat an insane 7 days in the world of alternative investments!

First it started with the inevitable deflation of bitcoin prices from their unsustainable rise to $260 to about $50 in just over 24 hours. This prompted a huge ‘i told you so’ rant all over the media with everyone bashing bitcoins without even knowing what they are in most cases. It did, however, provide bitcoins with massive media exposure just enough to gain the attention of Bloomberg and CNBC; mission accomplished. I actually heard an anchor this morning report the spot price of bitcoins on Bloomberg radio quickly followed by a story on why gold fell so hard.

Now about gold. Just 4 days ago, in the midst of the media frenzy about the collapse of bitcoin prices, gold takes a nose dive from it’s lackluster levels stuck around $1550 to an eye-opening $100 drop to $1450 territory, then another plunge in the Asian sell-off down to around $1330. All of a sudden bitcoins became an afterthought and the spotlight was back on the perennial precious metal that everyone loves to hate.

Bitcoin’s sell off was supposedly caused by profit taking and panic selling while gold’s sell-off started when Cypress said it needed to sell it’s gold to pay its copious debts off, then after Mario Draghi decided to OK that lovely idea, gold went into panic sell mode. To be completely frank, it’s not really completely clear what caused gold and bitcoins to spiral back down to Earth nearly at the same time but I feel like it opens the door to some serious pro-government conspiracy theories.

Let’s see what the next week brings on before I make any pointless predictions from here.